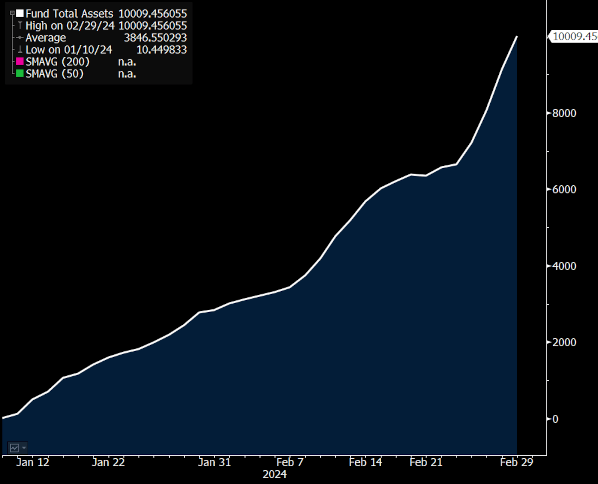

According to data from CoinGlass, BlackRock’s iShares Bitcoin Trust (IBIT) now manages over $10 billion in assets under management (AUM).

Bloomberg ETF analyst Eric Balchunas highlighted that IBIT is among only 152 exchange-traded funds (ETFs) to surpass the $10 billion threshold, out of approximately 3,400 ETFs currently available.

Balchunas noted that IBIT achieved this milestone faster than any other ETF, having launched on January 11 and reaching the $10 billion mark in less than two months. In comparison, ETF.com pointed out that the first gold ETF took two years to reach $10 billion in AUM.

The Grayscale Bitcoin Trust (GBTC) boasts a larger AUM of $27 billion in comparison to BlackRock’s IBIT. However, GBTC was initially established as an investment fund in 2013 before transitioning to an ETF this year, and unlike IBIT, it didn’t commence with zero assets.

The Fidelity Wise Origin Bitcoin Fund (FBTC), the third largest spot Bitcoin ETF, currently manages $6.5 billion in assets under management. Collectively, all ten existing spot Bitcoin ETFs hold a combined AUM of $48.2 billion.

Reasons behind IBIT’s Growth

Balchunas suggested that IBIT’s increasing AUM stems from inflows, as ETFs often face challenges in achieving the initial $10 billion, which must come from inflows. However, reaching the second $10 billion is typically easier due to market appreciation.

IBIT surpassed the $10 billion milestone on March 1, reporting $7.7 billion in inflows since its launch, including $603 million in inflows on Feb. 29. According to Balchunas, this positions IBIT as the ETF with the third-longest streak of inflows.

The rising price of Bitcoin may also contribute to IBIT’s growth. As of March 4, Bitcoin is valued at $67,200, marking a 25.3% increase over the past week and a 51.0% increase over two months.

Additionally, reports suggest that certain financial institutions, including Bank of America’s Merrill Lynch and Wells Fargo, have begun offering access to BlackRock’s Bitcoin ETF and competing exchange-traded funds, potentially fueling recent growth.